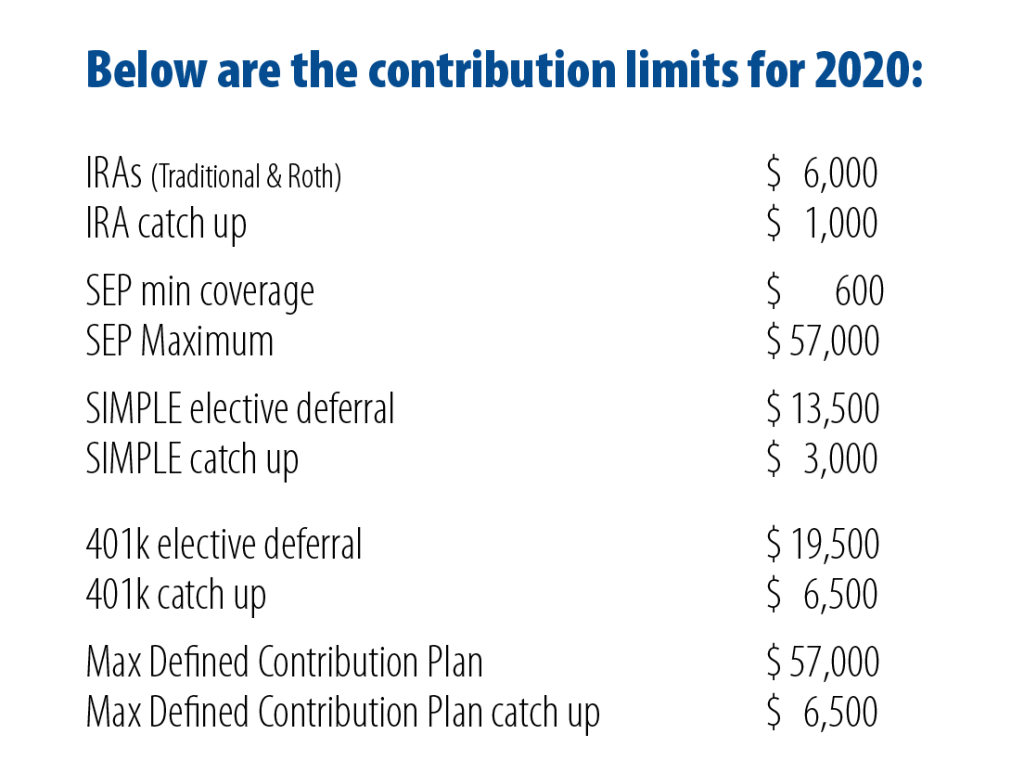

As 2019 comes to a close, we all begin to look ahead to 2020. For 2020 many of the contribution limits for retirement accounts increased from their 2019 levels. In calculating these, IRS compares the official cost of living increase from September of 2019 against September of 2018. Because the cost of living was higher in 2019, many of the indexed (for inflation) contributions, limitations, thresholds, etc in the IRS were adjusted.

In reviewing these limits, some definitions and rules need to be kept in mind:

With Traditional IRAs, contributions can only be made to the extent you have earned income up to the maximum allowed in the table above. Earned income is defined as W-2 income or earning subject to self employment. There are other qualifiers which we will not discuss here. (examples: if you have W-2 wages of $50,000 you may contribute $6,000. If you have W-2 wages of $3,000, you may only contribute $3,000). Also, you may not contribute after you reach the age of 70 ½.

Please keep in mind these are contribution limits-not deductible amounts. It is possible to make a nondeductible Traditional IRA contribution which will be discussed in a future article.

Roth IRAs follow similar rules with two big exceptions. First, for married couples, if your Adjusted Gross Income is greater than $196,000 then your contribution will be limited and once your AGI rises above $206,000 you will be precluded from contributing to a Roth (For singles and ‘head of household’ the contribution phase out begins at $124,000 and the contribution is fully eliminated at $139,000). Second, if you have earned income and meet the income limitations, you may contribute past age 70 ½.

With both Traditional and Roth IRAs taxpayers older and 50 ½ may contribute an additional $1,000 referred to as a catch up contribution.

The minimum SEP (Self Employed Pension) coverage begins for employees earning at least $600. What this means is that Employers who maintain a SEP plan must contribute for employees earning more than $600 per the plan calculation.

An elective deferral is the amount of earnings an employee ‘elects’ to contribute to their respective plan maintained by the employer. The elective limits for SIMPLE IRA Plans is $13,000 and for 401k, 403b, and Government plans $19,500.

Catch up contributions to SIMPLE Plans ($3,000) and other Qualified Plans ($6,500), can be made if you are older than 50 ½.

This is a brief overview of the contribution limits to the plans that the majority of Americans maintain. More detail is available in IRS Notice 2019-59. For questions regarding your particular plan, you should contact your plan administrator or feel free to contact us at 240/575.3880 x250.